BingX, a leading global cryptocurrency exchange, is pleased to announce its decision to further expand into the Middle East and North Africa (MENA) markets. This strategic move is part of BingX's ongoing commitment to provide innovative and reliable trading services to users worldwide. By investing in these vibrant markets, BingX aims to connect with a larger user base and promote the adoption of cryptocurrencies in the region.

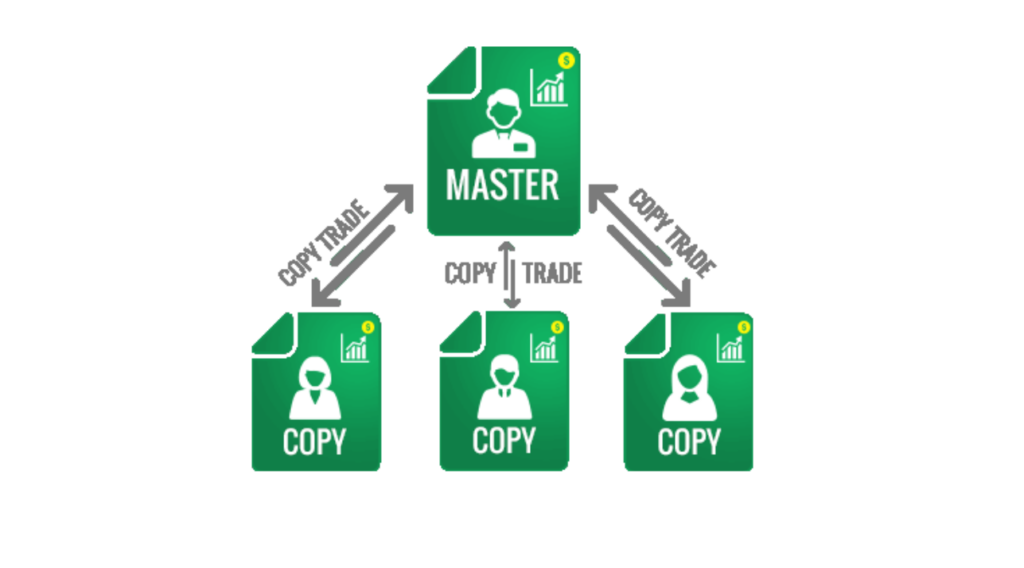

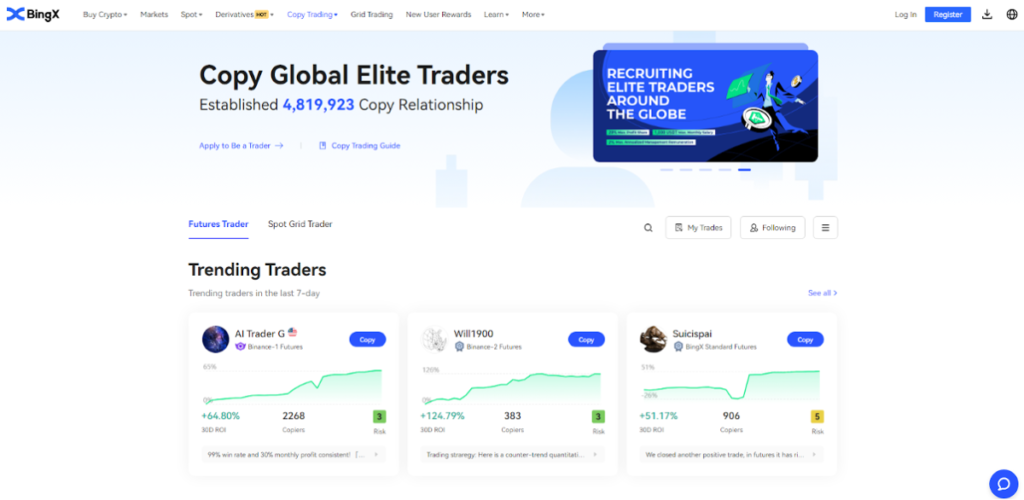

BingX has established itself as a prominent player in the cryptocurrency industry, offering a comprehensive range of services, including spot trading, derivatives, copy trading, and grid trading. With over 5 million users across 100+ countries and regions, BingX is striving to enhance the trading experience further with advanced solutions for its global user base. Notably, BingX is renowned for its commitment to user satisfaction, transparency, and innovation. The core focus of BingX's operations is relentless dedication toward revolutionizing the cryptocurrency trading experience. BingX envisions expanding the accessibility of cryptocurrencies and making these assets more user-friendly, catering to individuals from all walks of life. With the goal of becoming the “gateway” for billions of cryptocurrency users, BingX aims to foster comprehensive financial inclusivity and broaden the widespread adoption of digital assets worldwide.

With an impressive presence in Asia, Europe, and the Americas, BingX has positioned itself as a reliable platform for users across various continents. Now, the decision to expand BingX into the MENA markets is driven by the platform's strategic vision and commitment to global growth. The MENA region has witnessed a significant surge in interest in cryptocurrency usage, with an increasing number of individuals and businesses seeking reliable and secure platforms to trade digital assets. BingX recognizes the immense potential in this market and aims to meet the growing demand of cryptocurrency enthusiasts in MENA.

BingX will bring its strengths to the MENA market, including a robust infrastructure and advanced trading tools supporting a wide range of cryptocurrencies. By expanding into MENA, BingX will provide local traders with a seamless trading experience equipped with comprehensive features, enabling them to explore new investment opportunities and navigate the cryptocurrency landscape with confidence.

As part of its commitment to delivering an exceptional trading experience and fostering a vibrant cryptocurrency community in the MENA region, BingX is proud to introduce the BingX Partner Program. Through this program, local partners will benefit from higher-than-industry-standard commission rates. By combining BingX's reputable position as a leading cryptocurrency exchange with the local expertise and profound knowledge of its partners, the launch of this partner program is highly anticipated. The BingX Partner Program will provide tailored solutions and services to cater to the specific needs and preferences of MENA traders.

Elvisco Carrington, Director of PR and Communications at BingX, stated:

“We are thrilled to introduce BingX to the Middle East and North Africa market. As the demand for cryptocurrencies continues to rise in the region, we are committed to providing a reliable and user-friendly platform that meets the specific needs and preferences of MENA users. This expansion decision is a testament to our commitment to global accessibility and our vision for revolutionizing how people trade and invest in cryptocurrencies. We are excited to engage with vibrant markets and collaborate with local partners to create shared value.”

About BingX:

BingX is a leading cryptocurrency exchange providing spot trading, derivatives, copy trading, and grid trading services to over 100 countries and regions worldwide, with over 5 million users. BingX continues to connect users with professional traders and the platform in a safe and innovative manner.